Data Analysis & Visualization

Interactive Revenue Tool Developed for State Comptroller

Partner

Connecticut’s Office of the State Comptroller

Goals

Revamp online tool for users to calculate impact to state revenue of different tax policies and changes

Results

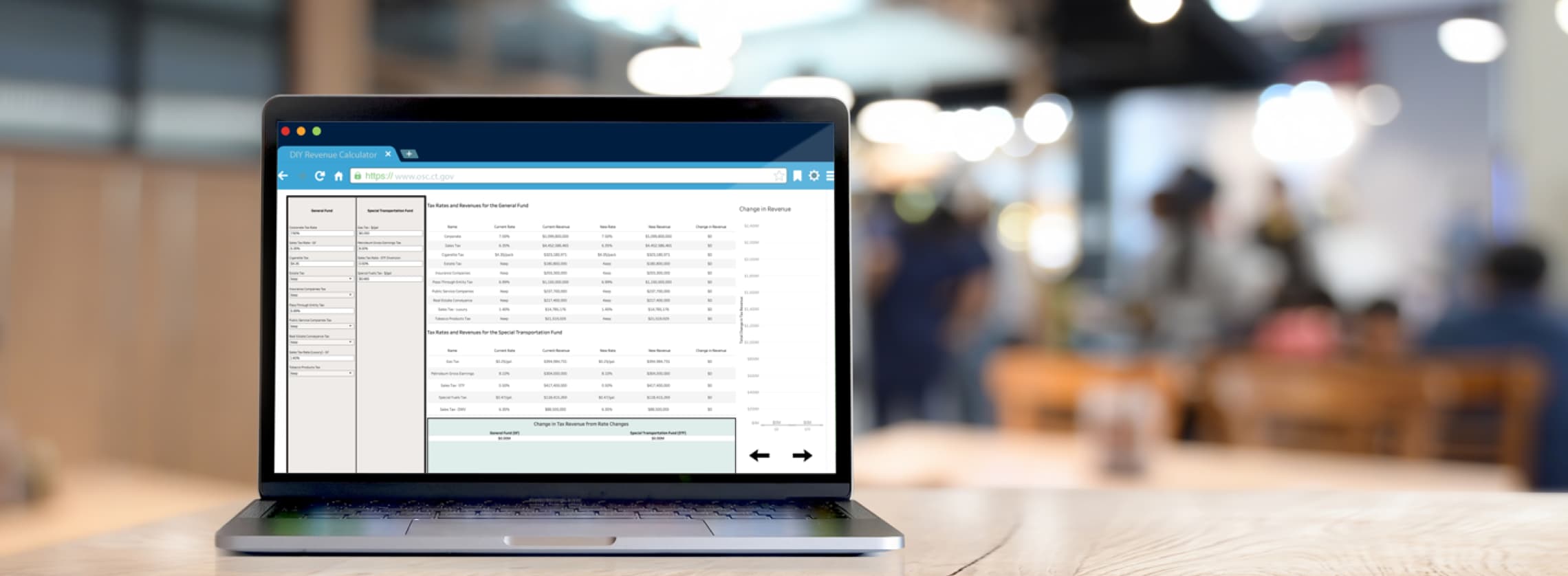

Successfully launched an interactive DIY Revenue Calculator that has been viewed and used thousands of times

Everyone knows they pay taxes, but what’s not always clear is how state tax systems work and how tax policy changes impact the revenue states collect. In February 2018, Connecticut’s Office of the State Comptroller aimed to fix this when they partnered with us to design and develop an online interactive, public-facing revenue tool that would allow users to calculate the impact of selected revenue policies and changes.

While the Comptroller’s Office had previously created a revenue calculator, it was not updated with the latest tax laws and state revenue figures, nor was it easily accessible for users. The Comptroller’s Office wanted a revamped tool that would bolster usability, improve accuracy, and increase transparency.

With this mind, our team developed a new and improved Do-it-Yourself (DIY) Revenue Calculator over several months using the visualization software Tableau, and successfully launched it on the Comptroller’s website. The new interactive Calculator allowed users to 1) specify changes in existing state tax rates, 2) eliminate existing state tax exemptions and credits, and 3) implement new state taxes and fees to change the estimated amount and sources of state revenue.

Additionally, our team created a public frequently asked questions document about the Calculator as well as an accompanying full methodology document outlining the tool’s calculations and sources. Our team has also continually updated the Calculator with the latest revenue estimates, policy changes, and tax proposals so the tool remains up-to-date and accurate.

Since its launch in June 2018, the revamped Calculator has been viewed thousands of times and has made it easier for the general public to see how Connecticut’s tax system works and what policy changes mean for their wallets and the state’s coffers.

Read more